0000720500falseDEF 14A0000720500asys:MrWhangMember2022-10-012023-09-300000720500ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2024-10-012025-09-300000720500ecd:NonPeoNeoMemberasys:AmountsReportedUnderStockAwardsColumnInSummaryOfCompensationTableMember2023-10-012024-09-3000007205002022-10-012023-08-0800007205002023-10-012024-09-300000720500ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2024-10-012025-09-300000720500asys:AmountsReportedUnderOptionAwardsColumnInSummaryOfCompensationTableMemberecd:PeoMember2023-10-012024-09-300000720500ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-10-012024-09-300000720500ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2024-10-012025-09-300000720500ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2023-10-012024-09-300000720500ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2023-10-012024-09-300000720500ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2024-10-012025-09-300000720500asys:MrDaigleMember2022-10-012023-09-300000720500ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2023-10-012024-09-300000720500ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-10-012024-09-300000720500asys:MrDaigleMember2023-10-012024-09-300000720500ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-10-012024-09-300000720500asys:AmountsReportedUnderOptionAwardsColumnInSummaryOfCompensationTableMemberecd:PeoMember2024-10-012025-09-300000720500asys:AmountsReportedUnderStockAwardsColumnInSummaryOfCompensationTableMemberecd:PeoMember2024-10-012025-09-300000720500ecd:NonPeoNeoMemberasys:AmountsReportedUnderStockAwardsColumnInSummaryOfCompensationTableMember2024-10-012025-09-300000720500ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-10-012024-09-300000720500ecd:NonPeoNeoMemberasys:AmountsReportedUnderOptionAwardsColumnInSummaryOfCompensationTableMember2024-10-012025-09-300000720500ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-10-012024-09-300000720500ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2023-10-012024-09-300000720500ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2024-10-012025-09-300000720500ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2024-10-012025-09-300000720500ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2024-10-012025-09-300000720500asys:AmountsReportedUnderStockAwardsColumnInSummaryOfCompensationTableMemberecd:PeoMember2023-10-012024-09-3000007205002023-08-092023-09-300000720500ecd:NonPeoNeoMemberasys:AmountsReportedUnderOptionAwardsColumnInSummaryOfCompensationTableMember2023-10-012024-09-300000720500ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2024-10-012025-09-300000720500asys:MrDaigleMember2024-10-012025-09-300000720500asys:MrWhangMember2024-10-012025-09-3000007205002024-10-012025-09-300000720500asys:MrWhangMember2023-10-012024-09-300000720500ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2023-10-012024-09-3000007205002022-10-012023-09-300000720500ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2024-10-012025-09-300000720500ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2024-10-012025-09-30iso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Under Rule 14a-12

|

AMTECH SYSTEMS, INC. |

(Name of Registrant as Specified in its Charter) |

N/A |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☑ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)Amount Previously Paid:

(2)Form, Schedule or Registration Statement No.:

AMTECH SYSTEMS, INC.

58 SOUTH RIVER DRIVE, SUITE 370

TEMPE, ARIZONA 85288

NOTICE OF 2026 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MARCH 4, 2026

To Our Shareholders:

The 2026 Annual Meeting of Shareholders (the “Annual Meeting”) of AMTECH SYSTEMS, INC., an Arizona corporation (the “Company”), will be held at Amtech Systems, Inc., 58 South River Drive, 3rd Floor Meeting Room, Tempe, Arizona, on Wednesday, March 4, 2026, at 9:00 a.m., Arizona time, for the following purposes:

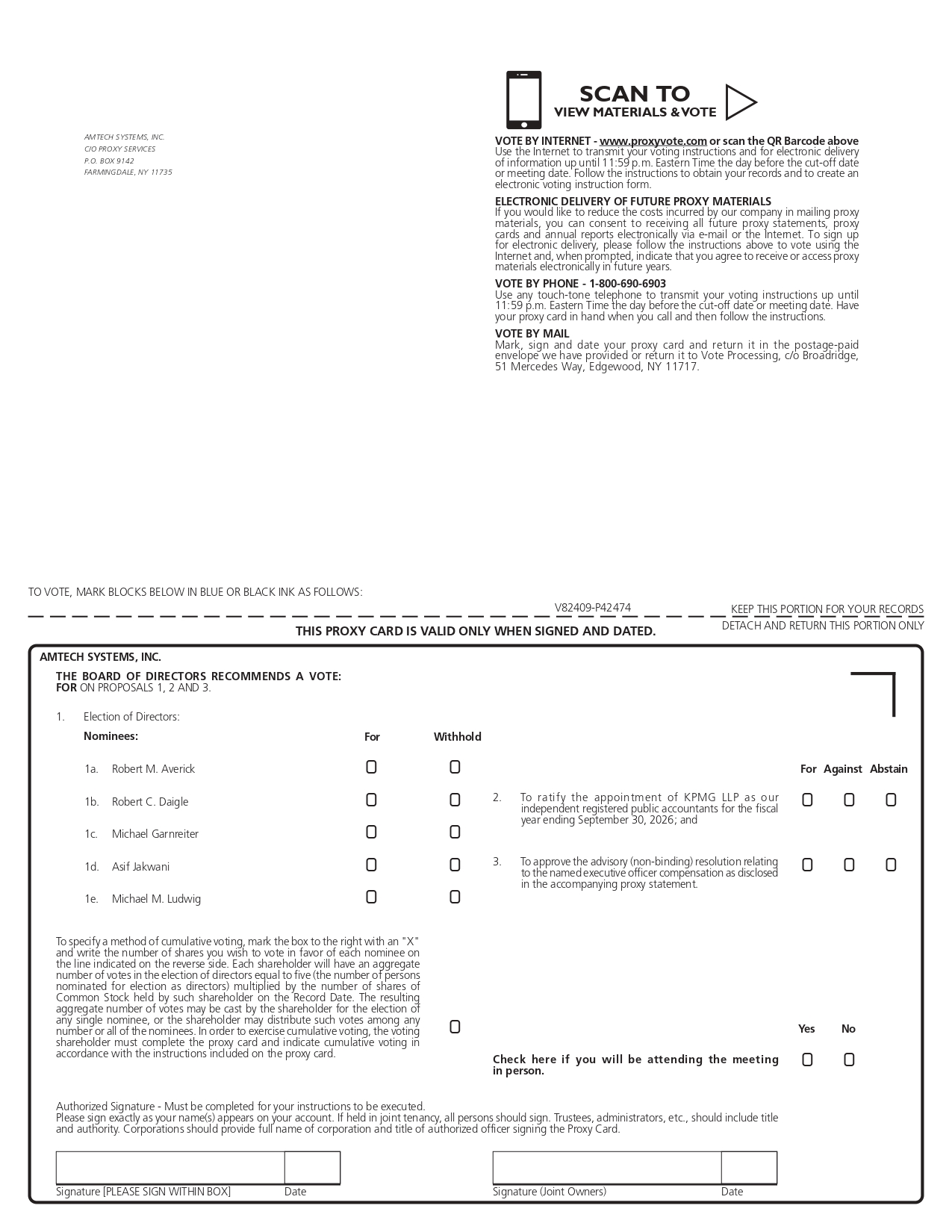

1.To elect five (5) directors to serve until the 2027 Annual Meeting of Shareholders and until their successors are duly elected and qualified;

2.To ratify the appointment of KPMG LLP as our independent registered public accountants for the fiscal year ending September 30, 2026;

3.To approve the advisory (non-binding) resolution relating to the named executive officer compensation as disclosed in the accompanying proxy statement; and

4.To transact such other business as may properly come before the meeting or any postponement or adjournment thereof.

The foregoing items of business are more fully described in the proxy statement accompanying this notice. The Company is not presently aware of any other business to come before the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Meeting

The Proxy Statement and annual report to shareholders on Form 10-K for the fiscal year ended September 30, 2025 (the “2025 Annual Report”) are also available at www.proxydocs.com/ASYS. The materials available on this website include this notice, the proxy statement and the 2025 Annual Report.

The Board of Directors has fixed the close of business on January 13, 2026 as the record date (the “Record Date”) for the determination of shareholders who hold the Company’s common stock who are entitled to notice of, and to vote at, the Annual Meeting or any postponement or adjournment thereof. Shareholders are reminded that their shares of the Company’s common stock can be voted at the Annual Meeting only if they are present at the Annual Meeting in person or by valid proxy. A copy of the 2025 Annual Report, which includes our audited financial statements, was mailed with this notice and Proxy Statement on or about January 30, 2026 to all shareholders of record on the Record Date.

Management of the Company cordially invites you to attend the Annual Meeting. Your attention is directed to the attached Proxy Statement for a discussion of the foregoing proposals and the reasons why the Board of Directors encourages you to vote FOR the approval of such proposals.

|

By Order of the Board of Directors: |

/s/ Robert C. Daigle |

Robert C. Daigle, CEO |

Tempe, Arizona

January 23, 2026

|

IMPORTANT: IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AND VOTED AT THIS MEETING WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON. PLEASE VOTE YOUR SHARES PROMPTLY BY COMPLETING AND RETURNING YOUR PROXY CARD OR BY VOTING ON THE INTERNET OR BY TELEPHONE. |

AMTECH SYSTEMS, INC.

PROXY STATEMENT

2026 ANNUAL MEETING OF SHAREHOLDERS

TABLE OF CONTENTS

AMTECH SYSTEMS, INC.

58 SOUTH RIVER DRIVE, SUITE 370

TEMPE, ARIZONA 85288

PROXY STATEMENT

The Board of Directors, or “Board,” of Amtech Systems, Inc., an Arizona corporation (the “Company” or “Amtech”), is soliciting proxies to be used at the 2026 Annual Meeting of Shareholders to be held on Wednesday, March 4, 2026, at 9:00 a.m., Arizona time, and any adjournment or postponement thereof (the “Annual Meeting” or “Meeting”). A copy of the Notice of the Meeting accompanies this Proxy Statement. This Proxy Statement and the accompanying form of proxy will be mailed to all shareholders entitled to vote at the Annual Meeting beginning January 30, 2026.

Who Can Vote

Shareholders of record as of the close of business on January 13, 2026 (the “Record Date”), may vote at the Annual Meeting and at any adjournment or postponement of the Meeting. On the Record Date, 14,394,885 shares of our common stock, $0.01 par value (“Common Stock”), were issued and outstanding. A complete list of shareholders entitled to vote at the Annual Meeting shall be open to the examination of any shareholder, for any purpose germane to the Annual Meeting, during ordinary business hours for at least ten days prior to the Annual Meeting at our offices at 58 South River Drive, Suite 370, Tempe, Arizona 85288.

What Constitutes a Quorum

The presence, in person or by proxy, of the holders of a majority of the voting power of the issued and outstanding shares of Common Stock as of the Record Date entitled to vote is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes are included in the number of shares of Common Stock present at the Meeting for purposes of determining a quorum. An abstention is a shareholder’s affirmative choice to decline to vote on a proposal. Under Arizona law, abstentions are counted as shares of Common Stock present and entitled to vote at the Annual Meeting. A broker “non-vote” occurs when a nominee holding shares of Common Stock for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner.

How to Attend the Meeting

If you are a shareholder of record, which means you hold your shares in your name, you may attend the meeting. If you own shares in the name of a bank, broker or other holder of record (“street name”), you will need to ask your broker or bank for a copy of the proxy they received from us. You will need to bring the proxy with you to the Annual Meeting, which will be held at Amtech Systems, Inc., 58 South River Drive, 3rd Floor Meeting Room, Tempe, Arizona, on Wednesday, March 4, 2026, at 9:00 a.m., Arizona time.

How to Vote

If your shares are registered directly in your name, you may vote:

Via the Internet. If you received the Notice or a printed copy of the proxy materials, follow the instructions in the Notice or on the proxy card.

By Telephone. If you received a printed copy of the proxy materials, follow the instructions on the proxy card.

By Mail. If you received a printed copy of the proxy materials, complete, sign, date, and mail your proxy card in the enclosed, postage-prepaid envelope.

In Person at the Annual Meeting. If you choose to vote in person at the Meeting, you must bring a government-issued proof of identification that includes a photo (such as a driver’s license or passport) and either the enclosed proxy card or other verification of your ownership of shares of Common Stock as of the Record Date.

If your shares are held in street name (held for your account by a broker, bank or other nominee):

Your broker, bank or other nominee should give you instructions for voting your shares. You may vote by Internet, telephone or mail as instructed by your broker, bank or other nominee. You may also vote in person if you obtain a legal proxy from your broker, giving you the right to vote your shares at the Meeting and you bring verification of your ownership of shares of Common Stock to the Meeting.

We are not aware of any other matters to be presented at the Annual Meeting, except those described in this Proxy Statement. However, if any other matters not described in this Proxy Statement are properly presented at the Annual Meeting, the proxies will use their own judgment to determine how to vote your shares. If the Annual Meeting is adjourned, your Common Stock may be voted by the proxies on the new meeting date as well, unless you have revoked your proxy prior to that time.

What are the Voting Rights of Holders of Common Stock

Except as set forth below with respect to the ability to cumulate votes for directors, the holders of Common Stock will be entitled to one vote per share of Common Stock.

What Vote is Required to Approve Each Item

Proposal 1 – Election of Directors: If a quorum is present, the five nominees who receive a plurality of the votes cast at the Annual Meeting will be elected. Broker non-votes and abstentions will have no effect on the results of the vote for the election of directors.

Proposal 2 – Ratification of the Independent Registered Public Accountants: If a quorum is present, a majority of votes cast by holders of Common Stock represented and entitled to vote at the Annual Meeting will constitute a ratification of the appointment of KPMG LLP as our independent registered public accountants. An abstention with respect to this proposal will be counted for the purposes of determining the number of shares of Common Stock entitled to vote that are present in person or by proxy. Accordingly, an abstention will have the effect of an against vote. Broker non-votes will not affect the outcome of this proposal.

Proposal 3 – Advisory Vote On Named Executive Officer Compensation: If a quorum is present, a majority of votes cast by holders of Common Stock represented and entitled to vote at the Annual Meeting will constitute approval of the advisory vote on the compensation of our named executive officers. Because the vote is advisory, it will not be binding upon the Board. However, the Compensation Committee will take into account the outcome of the vote when considering future executive compensation arrangements. An abstention with respect to this proposal will be counted for the purposes of determining the number of shares of Common Stock entitled to vote that are present in person or by proxy. Accordingly, an abstention will have the effect of an against vote. Broker non-votes will not affect the outcome of this proposal.

Revoking Your Proxy or Changing Your Vote

You may revoke your proxy and/or change your vote at any time before the Meeting.

If your shares are registered directly in your name, you must do one of the following:

Via the Internet or by Telephone. Cast your votes again via the Internet or by telephone by following the instructions provided on the proxy card. Only the last Internet or telephone vote will be counted.

By Mail. Sign a new proxy card and submit it as instructed above, or send a notice revoking your proxy to the Secretary so that it is received on or before March 3, 2026.

In Person at the Annual Meeting. Attend the Meeting and vote in person. Presence at the Meeting will not revoke your proxy unless you specifically request that your proxy be revoked.

If your shares are held through a broker or other nominee and you would like to change your voting instructions, please follow the instructions provided by your broker.

How Votes are Counted

Inspectors of election will be appointed for the Annual Meeting. The inspectors of election will determine whether or not a quorum is present and will tabulate votes cast by proxy or in person at the Annual Meeting. If you have returned valid proxy instructions or attend the Annual Meeting in person, your Common Stock will be counted for the purpose of determining whether there is a quorum. Abstentions and broker non-votes will be included in the determination of the number of shares of Common Stock represented for a quorum. Generally, broker non-votes occur when a beneficial owner does not provide instructions to their broker with respect to a matter on which the broker is not permitted to vote without instructions from the beneficial owner. In tabulating the voting result for any particular proposal, shares of Common Stock that constitute broker non-votes are not considered entitled to vote on that proposal. Accordingly, broker non-votes will not affect the outcome of any matter being voted on at the Annual Meeting, assuming that a quorum is obtained. If a proposal requires a majority of votes cast, abstentions typically have no effect because they are not considered “votes cast.” If a proposal requires either (i) a majority of shares of Common Stock present at the Annual Meeting or represented by proxy and entitled to vote on the proposal or (ii) a majority of all outstanding shares of Common Stock, abstentions will effectively count as votes against such proposal because they are included in the total number of shares of Common Stock present or outstanding but do not contribute to the affirmative vote count.

Costs of this Proxy Solicitation

We will pay the costs of preparing and mailing the Notice of Annual Meeting and Proxy Statement, including the charges and expenses of brokerage firms, banks and others who forward solicitation material to beneficial owners of the Common Stock. We will solicit proxies by mail. Our officers and directors may also solicit proxies personally, or by telephone or facsimile, without additional compensation. We have not retained any outside party to assist in the solicitation of proxies; however, we have retained Broadridge Financial Solutions, Inc. to provide certain administrative services in connection with the proposals in this Proxy Statement, including coordinating the distribution of proxy materials to beneficial owners of Common Stock, contacting shareholders to ensure they have received this Proxy Statement and overseeing the return of proxy cards.

Annual Report

Our Annual Report to Shareholders for the fiscal year ended September 30, 2025 (the “Annual Report”) has been mailed concurrently with the mailing of the Notice of Annual Meeting and Proxy Statement to all shareholders entitled to notice of, and to vote at, the Annual Meeting. The Annual Report is not incorporated into this Proxy Statement and is not considered proxy-soliciting material.

Audit Committee Report

The information contained in the “Audit Committee Report” shall not be deemed “filed” with the Securities and Exchange Commission (the “SEC”) or subject to Regulations 14A or 14C or to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act.

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

(Item No. 1 on the Proxy Card)

Number of Directors to be Elected

Our directors are elected annually as provided in our Amended and Restated Bylaws. Once elected, directors hold office until their terms expire at the next annual meeting of shareholders and their successors are elected (or, if earlier, upon the director’s death, resignation or removal).

The Board regularly assesses its size and composition and the skill sets of each director to ensure an appropriate diversity of perspectives, viewpoints, backgrounds and skills in light of our current and future business objectives and the evolving nature of our product offerings and technology in the highly competitive semiconductor markets in which we compete.

As of the record date, our Board had five directors, each of whom was elected at our 2025 annual meeting of shareholders. Each of the five nominees named herein has consented to being named as a nominee in this proxy statement and to serve as a director if elected. The designated proxies intend to vote your proxy for the election of each such nominee, unless otherwise directed. If, contrary to our expectations, any nominee is unable to serve or for good cause will not serve, your proxy will be voted for a substitute nominee designated by the Board, or the Board may choose to reduce its size.

Vote Required

The five nominees receiving the highest number of votes cast at the Annual Meeting will be elected. There is cumulative voting in the election of directors. This means that each holder of Common Stock present at the Annual Meeting, either in person or by proxy, will have an aggregate number of votes in the election of directors equal to five (the number of persons nominated for election as directors) multiplied by the number of shares of Common Stock held by such shareholder on the Record Date. The resulting aggregate number of votes may be cast by the shareholder for the election of any single nominee, or the shareholder may distribute such votes among any number or all of the nominees. In order to exercise cumulative voting, the voting shareholder must complete the proxy card and indicate cumulative voting in accordance with the instructions included on the proxy card.

Nominees for Director

Our Board is responsible for supervision of the overall affairs of the Company. Our current Board has nominated the following individuals to serve on the Board for the following year:

Robert M. Averick

Robert C. Daigle

Michael Garnreiter

Asif Y. Jakwani

Michael M. Ludwig

There are no family relationships among any of the director nominees or executive officers. Each nominee was recommended by a non-employee director.

Our Board recommends a vote FOR the election of the five nominees under Proposal No. 1. The persons appointed by the Board as proxies intend to vote for the election of each of the nominees, for a term to expire at the next annual meeting, unless you indicate otherwise on the proxy or voting instruction card. In that regard, our Board solicits authority to cumulate such votes.

If any nominee should become unavailable for any reason, which we do not anticipate, the proxy will be voted “for” any substitute nominee, or nominees, who may be selected by the Board prior to, or at, the Annual Meeting, or, if no substitute is selected by the Board prior to or at the Annual Meeting, for a motion to reduce the present membership of the Board to the number of nominees available. The information concerning the nominees and their shareholdings has been furnished by them to the Company.

Information Concerning Directors and Executive Officers

The following table sets forth information regarding the executive officers and individuals nominated to serve as directors of the Company as of the date of this filing.

|

|

|

Name |

Age |

Position with the Company |

Robert C. Daigle |

62 |

President, Chief Executive Officer, Chairman of the Board |

Mark Weaver |

65 |

Interim Chief Financial Officer, Secretary |

Robert M. Averick |

59 |

Director |

Michael Garnreiter |

73 |

Director |

Asif Y. Jakwani |

57 |

Director |

Michael M. Ludwig |

64 |

Director |

Robert C. Daigle has been a Director since August 2021 and was appointed Chairman of the Board of Directors effective May 11, 2022. Mr. Daigle was appointed Chief Executive Officer effective August 8, 2023. From March 2013 to December 2022, Mr. Daigle served as the Chief Technology Officer of Rogers Corporation (“Rogers”), a publicly traded global leader in engineered materials, including advanced electronic and elastomeric materials that are used in applications for EV/HEV, automotive safety and radar systems, mobile devices, renewable energy, wireless infrastructure, energy-efficient motor drives, and industrial equipment. Mr. Daigle previously served in a number of other senior executive roles during his 30-year tenure at Rogers. Mr. Daigle holds a B.S in Chemical Engineering and Materials Engineering from the University Connecticut and an MBA from Rensselaer Polytechnic Institute.

Mark Weaver was appointed as Amtech’s Interim Chief Financial Office effective December 16, 2025. Mr. Weaver previously served as Vice President, Chief Accounting Officer and Corporate Controller of Rogers from November 2017 until May 2024. From December 2016 through November 2017, Mr. Weaver served as Vice President, Corporate Controller and Chief Accounting Officer of Internap Corporation, a public company based in Atlanta, Georgia that specializes in the provision of Internet infrastructure services. From March 2015 to December 2016, Mr. Weaver served as a finance and reporting consultant at Resources Global Professionals, a multinational professional services firm. From 2011 through 2014, Mr. Weaver served as Chief Accounting Officer and Vice President, US GAAP Reporting and Compliance at NXP Semiconductors N.V., a public company based in the Netherlands. Mr. Weaver holds a B.S. in Accounting from Kings College and an MBA from Fairleigh Dickinson University. Mr. Weaver is a Certified Public Accountant in the State of Pennsylvania.

Robert M. Averick has been a Director since January 2016 and was appointed Lead Independent Director on December 9, 2025. Mr. Averick has over 25 years of experience as a small-capitalization, value-driven public equity portfolio manager. His previous work experience includes positions of increasing responsibility within structured finance, strategic planning and consulting. Mr. Averick received an undergraduate degree in Economics from The University of Virginia and a Masters in Business Administration in Finance from The University of Pennsylvania, The Wharton School of Business. Mr. Averick has worked as a portfolio manager at Kokino LLC since 2012. Mr. Averick and certain entities to which his employer provides investment management services currently own in excess of 20% of Amtech’s outstanding shares. He previously served on our Board during 2005 and 2006. Mr. Averick also serves on the board of directors of Gulf Island Fabrication, Inc., a publicly-traded fabricator of complex steel structures, modules and marine vessels and is a member of its compensation committee and corporate governance and nominating committee. Additionally, Mr. Averick currently serves as Chairman of PhoneX Holdings, Inc., an OTC bulletin-board company, and he previously served as a director of Key Technology, Inc. until its sale in 2018. Mr. Averick serves as Chairman of our Compensation Committee and as a member of our Audit and Nominating and Governance Committees. Mr. Averick’s experience in finance and strategic planning allows him to provide valuable advice to the Board of Directors and the Committees on which he serves.

Michael Garnreiter has been a Director since February 2007 and served as Lead Independent Director from May 2020 to December 9, 2025. He is the Chairman of our Audit Committee and serves as a member of our Compensation and Nominating and Governance Committees. Mr. Garnreiter is our designated financial expert on the Audit Committee. Mr. Garnreiter, for the past three years, has served as Interim Chief Financial Officer for LeVecke Corporation, a privately-held, California-based distilled spirits bottling company. He retired from that role in early 2023. Also, he retired in December 2015 as Vice President of Finance and Treasurer of Shamrock Foods, a

privately-held manufacturer and distributor of foods and food-related products. From January 2010 until August 2012, Mr. Garnreiter was a managing director of Fenix Financial Forensics, a Phoenix-based litigation and financial consulting firm. From August 2006 until January 2010, he was a managing member of Rising Sun Restaurant Group LLC, and, from December 2008 until December 2009, he was president of New Era Restaurants, LLC, both of which are privately-held restaurant operating companies. From 2002 to 2006, Mr. Garnreiter was CFO of Main Street Restaurant Group, a publicly-traded restaurant operating company, and from 1976 to 2002, he was a senior audit partner of Arthur Andersen LLP. Mr. Garnreiter serves on the boards of directors of Axon Enterprise, Inc. (as Chairman), a publicly-traded manufacturer of non-lethal protection devices, Knight-Swift Transportation Holdings Inc., a publicly-traded nationwide truckload transportation company, and Banner Health, a multi-state health care delivery system. He graduated from California State University Long Beach with a Bachelor of Science in Accounting and Business Administration. Mr. Garnreiter is a Certified Public Accountant in the State of Arizona and Certified Fraud Examiner. Mr. Garnreiter’s financial background and expertise allows him to provide valuable advice to the Board of Directors.

Asif Y. Jakwani has been a Director since January 2025. Mr. Jakwani was appointed to Amtech’s board on January 23, 2025. He served as Senior Vice President and General Manager of On Semiconductor Corporation (“Onsemi”) from February 2020 until March of 2024. Onsemi is a publicly-traded semiconductor company that specializes in delivering industry-leading intelligent power and intelligent sensing solutions that help customers solve challenging problems and greatly improve the safety, sustainability and power efficiency of end products in the automotive and industrial markets. As the general manager of the Advance Power Division (APD), Mr. Jakwani was responsible of all power discrete and modules for Onsemi including SiC, approximately 40% of Onsemi’s revenue in 2023. Under his leadership, Onsemi attained number 2 market share position in SiC in 2023, growing 4x from 2022. During his seventeen year career at Onsemi, Mr. Jakwani held various positions with increasing responsibilities. Prior to joining Onsemi in 2007, Mr. Jakwani held marketing and design engineering roles with Tyco Electronics Power Systems and Current Technology, Inc, a subsidiary of Danaher Corporation. He graduated from Lamar University with a Bachelor of Science Degree in Electrical Engineering, the University of Texas at Austin with a Master of Science Degree in Electrical Engineering, and the University of Texas at Dallas with an MBA. Mr. Jakwani’s technical background and expertise allows him to provide valuable advice to the Board of Directors.

Michael M. Ludwig has been a Director since January 2023. He served as Senior Vice President, Chief Financial Officer and Treasurer of Rogers from September 2018 until May 2021. Rogers is a publicly-traded global leader in engineered materials, including advanced electronic and elastomeric materials that are used in applications for EV/HEV, automotive safety and radar systems, mobile devices, renewable energy, wireless infrastructure, energy-efficient motor drives, and industrial equipment. From May 2011 to March 2018, Mr. Ludwig served as Senior Vice President and Chief Financial Officer of FormFactor, Inc., a publicly-traded global leader in the design and manufacturing of advanced probe cards, analytical probes, probe stations, metrology systems, thermal systems and cryogenic systems sold to semiconductor and scientific institutions. Prior to May 2011, Mr. Ludwig held various senior financial management positions at FormFactor, Elo TouchSystems, Inc. and Beckman Coulter. Mr. Ludwig began his career in public accounting at Arthur Young. He graduated from California State Polytechnic University, Pomona with a Bachelor of Science in Business Administration and Accounting. Mr. Ludwig serves as Chairman of our Nominating and Governance Committee and as a member of our Audit and Compensation Committees. Mr. Ludwig’s financial background and expertise allows him to provide valuable advice to the Board of Directors and the Committees on which he serves.

Information About Board and Committee Meetings

Information concerning our Board and the three committees maintained by our Board is set forth below. Pursuant to Nasdaq and SEC rules, during fiscal 2025 the majority of our directors were not employees of the Company and were “independent” within the meaning of the Nasdaq Listing Rules and SEC standards. Importantly, all members of the Audit, Compensation, and Nominating and Governance Committees are independent. Currently, our independent directors are Robert M. Averick, Michael Garnreiter, Asif Y. Jakwani, and Michael M. Ludwig. Additionally, each member of the Audit Committee is financially literate, and one of the Audit Committee members, Michael Garnreiter, has financial management expertise as required by Nasdaq’s rules and meets the SEC’s definition of an “audit committee financial expert.”

Our Board of Directors held seven (7) meetings during fiscal year 2025. None of our current directors who were directors during 2025 attended less than 75% of the aggregate of Board meetings and relevant committee meetings held during the year. Our Board has the authority under our Amended and Restated Bylaws, as amended, to increase or decrease the size of our Board and to fill vacancies, and the directors chosen to fill such vacancies will hold office

until our next annual meeting or until their successors are elected and qualified. We do not have a formal policy with respect to members of the Board attending our annual meetings. All of our Board members attended the 2025 annual meeting.

The Audit Committee, the Compensation Committee, and the Nominating and Governance Committee are the standing committees of our Board of Directors. The members of these committees as of January 13, 2026, are as follows:

Audit – Michael Garnreiter (Chairman), Robert M. Averick, Asif Y. Jakwani and Michael M. Ludwig

Compensation – Robert M. Averick (Chairman), Michael Garnreiter, Asif Y. Jakwani, and Michael M. Ludwig

Nominating and Governance – Michael M. Ludwig (Chairman), Robert M. Averick, Michael Garnreiter and Asif Y. Jakwani

The Audit Committee held five (5) meetings during fiscal year 2025. The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities with respect to the independent auditors and members of financial management, and our financial affairs, including financial statements and audits, the adequacy and effectiveness of the internal accounting controls and systems, compliance with legal and regulatory requirements, and the retention and termination of the independent registered public accounting firm. The Audit Committee has a written charter, which was updated in 2022, a copy of which is available on our website at www.amtechsystems.com.

The Audit Committee is composed of outside directors who are not officers or employees of the Company or its subsidiaries. In the opinion of our Board, and as “independent” is defined under Nasdaq Listing Rules and SEC standards, these directors are independent of management and free of any relationship that would interfere with their exercise of independent judgment as members of this committee. Additionally, each member of the Audit Committee is financially literate, and one of the Audit Committee members, Mr. Michael Garnreiter, has financial management expertise as required by Nasdaq’s rules and meets the SEC’s definition of an “audit committee financial expert.”

The Compensation Committee held one (1) meeting during fiscal year 2025. The Compensation Committee makes recommendations concerning officer compensation, benefit programs and retirement plans. Each member of the Compensation Committee is an “independent director” as defined in the Nasdaq Listing Rules and SEC standards. The Compensation Committee has a written charter, which was updated in 2022, a copy of which is available on our website at www.amtechsystems.com.

The Nominating and Governance Committee held two (2) meetings during fiscal year 2025. The Nominating and Governance Committee identifies and approves individuals qualified to serve as members of our Board and also evaluates the Board’s performance. In evaluating a prospective nominee, the Nominating and Governance Committee takes several factors into consideration, including such individual’s integrity, business skills, experience and judgment. The evaluation of director nominees by the Nominating and Governance Committee also takes into account the diversity of prospective Board members’ background, factoring in gender, race, ethnicity, differences in professional background, education, skills, and experience, and other individual qualities and attributes that contribute to the total mix of viewpoints and experience. The Nominating and Governance Committee also reviews whether a prospective nominee will meet our independence standards and any other director or committee membership requirements imposed by law, regulation or stock exchange rules. The Nominating and Governance Committee will consider, but is not required to approve, director nominations made by our shareholders, provided a written recommendation is received by us no later than the date shareholder proposals must be submitted for consideration prior to such annual meeting and all other applicable requirements have been satisfied. The Nominating and Governance Committee also develops and recommends corporate governance guidelines to the Board and provides oversight with respect to ethical conduct. Each member of the Nominating and Governance Committee is an “independent director” as defined in the Nasdaq Listing Rules and SEC standards. The Nominating and Governance Committee has a written charter, which was updated in 2022, a copy of which is available on our website at www.amtechsystems.com.

Board Leadership Structure

Mr. Robert C. Daigle currently serves as the Chairman of our Board of Directors (“Chairman”) and Chief Executive Officer (“CEO”). Our Corporate Governance Guidelines (discussed below) provide, among other things, that it is a best practice that the offices of Chairman and CEO be maintained as separate roles. In the absence of a separation of such roles, the Board will appoint a lead director who will have the duties and responsibilities as determined by the Board. Following Mr. Daigle’s appointment as our Chief Executive Officer, Mr. Garnreiter was appointed as the Company’s lead independent director. Effective December 9, 2025, Mr. Averick replaced Mr. Garnreiter as the Company’s lead independent director.

Executive Leadership Change – Effective December 29, 2025, Mr. Jenke resigned as the Company’s Chief Financial Officer to assume an executive role at another company. Effective December 16, 2025, the Company appointed Mark D. Weaver to serve as Interim Chief Financial Officer until such time as the Board has approved the appointment of a permanent Chief Financial Officer. The Company is in the process of searching for a permanent Chief Financial Officer.

Addition of New Director– In December 2024, the Board of Directors, after an extensive search, appointed Mr. Jakwani to the Board effective January 23, 2025.

Board’s Role in Risk Oversight

Our Board of Directors is actively engaged in the oversight of risks that could affect the Company, with key aspects of such oversight being conducted through the committees of the Board. The Audit Committee focuses on financial risks, primarily those that could arise from our accounting and financial reporting processes, and also oversees compliance-related legal and regulatory exposure. The Nominating and Governance Committee focuses on the management of risks associated with corporate governance matters, including board organization, membership and structure; management development; and appropriate approval and oversight mechanisms. The Compensation Committee focuses on the management of risks arising from our compensation policies and programs and, in particular, our executive compensation programs and policies.

While the committees of our Board are focused on the above specific areas of risk, the full Board of Directors retains responsibility for the general oversight of risk. Committee chairs are expected to, and do, provide periodic reports to the full Board regarding the risk considerations within each committee’s area of expertise. Periodic reports are provided to the Board or the appropriate committee by the executive management team on areas of material risk, including operational, financial, legal, regulatory and strategic risks. In addition, the general management and operating leadership of each of our divisions and subsidiaries review, with the full Board, their individual assessment of business risks and their approach to manage those risks. The Board relies upon these reports, and its discussions relating to such reports, to enable it to understand our strategies for the identification, management and mitigation of risks. This structure enables the Board and its committees to coordinate its risk oversight role. The Board’s approach to risk oversight does not directly affect the leadership structure of our Board of Directors, as described above.

DIRECTOR COMPENSATION

The Board’s general policy is that non-employee director compensation should be a mix of cash and equity. Our CEO, if also a director, receives no additional compensation for being a director. For fiscal 2025, no changes were made to the annual Board and committee compensation for non-employee directors.

The following table shows the annual retainers paid to each of our non-employee directors who served on the Board and as a Chairperson of applicable Board committees during fiscal 2025:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Board |

|

|

Audit |

|

|

Compensation |

|

|

Nominating and Governance |

|

Non-Employee Chairperson |

$ |

75,000 |

|

(1) |

$ |

15,000 |

|

|

$ |

7,500 |

|

|

$ |

7,500 |

|

Non-Employee Member |

$ |

40,000 |

|

|

|

|

|

|

|

|

|

|

(1)Mr. Daigle does not receive this payment for his service as Chairperson because he is an employee.

The 2025 Board retainers in the table above are paid, pro-rata, on a quarterly basis. We reimburse all of our directors for reasonable expenses incurred to attend our Board of Directors and committee meetings.

Beginning in 2023, our Chairman, if a non-employee director, and our other non-employee directors will receive $75,000 and $40,000, respectively, in Restricted Stock Units (“RSUs”) upon each re-election to the Board at our annual meeting of shareholders or at such other time as may be determined by the Board. These RSUs will vest on the one-year anniversary of the grant date. Mr. Daigle, who became our Chief Executive Officer effective August 8, 2023, will not receive such RSU grants while serving as an employee of the Company.

The following table shows the total dollar value of all fees earned and paid in cash to all individuals who were directors in fiscal 2025 and the grant date fair value of stock option awards to directors made in fiscal 2025.

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Fees Earned or

Paid in Cash (1) |

|

|

Stock

Awards (2) (3) |

|

|

Total |

|

Robert C. Daigle |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

Robert M. Averick |

|

$ |

47,500 |

|

|

$ |

40,001 |

|

|

$ |

87,501 |

|

Michael Garnreiter |

|

$ |

55,000 |

|

|

$ |

40,001 |

|

|

$ |

95,001 |

|

Michael M. Ludwig |

|

$ |

47,500 |

|

|

$ |

40,001 |

|

|

$ |

87,501 |

|

Asif Y. Jakwani (4) |

|

$ |

30,000 |

|

|

$ |

40,001 |

|

|

$ |

70,001 |

|

____________________

(1) Directors who are employees of the Company receive no additional compensation for serving as directors.

(2)Amounts represent the aggregate grant date fair value of RSU awards granted calculated in accordance with FASB ASC Topic 718. For a description of the calculation of the grant date fair value, refer to Note 12 of the consolidated financial statements included in our Annual Report on Form 10-K for fiscal 2025.

(3)As of September 30, 2025, Messrs. Averick, Garnreiter, Ludwig, and Jakwani each held 8,081 unvested RSU awards scheduled to vest on March 5, 2026. All other awards held were fully vested.

(4)Mr. Jakwani was appointed to the Board effective January 23, 2025.

EXECUTIVE COMPENSATION

We have opted to comply with the executive compensation rules applicable to “smaller reporting companies,” as such term is defined under the Securities Act of 1933, as amended, which require compensation disclosure for our principal executive officer and our next two most highly compensated executive officers (other than our principal executive officer (collectively, the “Named Executive Officers” or “NEOs”).

The following executives are our Named Executive Officers for fiscal 2025:

•Robert C. Daigle, Chief Executive Officer and Chairman of the Board; and

•Wade M. Jenke, Vice President, Chief Financial Officer/Chief Operations Officer

Compensation Philosophy

Our Compensation Committee is charged with the evaluation of the compensation of our executive officers and to assure that they are compensated effectively in a manner consistent with our compensation strategy and resources, competitive practice, and the requirements of the appropriate regulatory bodies.

Our Compensation Committee establishes our general compensation policies and specific compensation for each of our executive officers and administers our stock incentive program. In addition, our Compensation Committee is responsible for developing, administering and interpreting the compensation program for our named executive officers and other key employees. Our Compensation Committee may delegate some or all of its responsibilities to one or more subcommittees whenever necessary to comply with any statutory or regulatory requirements or if otherwise deemed appropriate by our Compensation Committee. Our Compensation Committee has the authority to retain consultants and other advisors to assist with its duties and has sole authority to approve the fees and other retention terms of such consultants and advisors.

Our compensation philosophy has the following basic objectives: align the interests of our executives and shareholders by rewarding executives when shareholder value increases and motivate our executives to manage our business to meet our short-term and long-term corporate goals and business objectives, and reward them for meeting these objectives. We use a mix of short-term compensation in the form of base salaries and cash incentive bonuses and long-term compensation in the form of equity incentive compensation to provide a total compensation structure that is designed to encourage our executives to achieve these objectives. Our performance, including, but not limited to, return on equity, return on invested capital, earnings, revenue growth, cash flow, and continuous improvement initiatives, is a significant part of our evaluation and compensation levels.

In December 2024, the Compensation Committee changed the metrics to be used in the cash incentive bonus program for fiscal 2025 from a return-on-invested-capital (“ROIC”) metric to an earnings before interest, taxes, depreciation, and amortization (“EBITDA”) based metric. The Board of Directors established an earnings before interest, taxes, depreciation, amortization, and stock-based compensation (“EBITDAS”) threshold for fiscal 2025 and will do so each year thereafter. Targets will be based on an employee’s level within the Company. Employees working in sales generally participate in a commission plan, and certain other personnel, such as marketing directors, participate in both the commission plan and the bonus plan on a hybrid basis. As discussed below, the Company’s Chief Executive Officer is not eligible to participate in the bonus program. As with the ROIC metric, the EBITDAS based metric will be used to incentivize participants for profitability and balance sheet management. The equity incentive plan is designed to include defined goals and objectives, the achievement of which may result in the issuance of stock options or restricted stock units to executives.

2025 Base Salary, Annual Incentive Bonuses and Benefits

The compensation of our named executive officers is determined and approved by our Compensation Committee. Base salaries and annual incentive bonus awards are intended to provide a level of compensation sufficient to attract and retain an effective management team, when considered in combination with the other components of the executive compensation program. In general, we seek to provide a base salary level and a target bonus award level designed to reflect each executive officer’s scope of responsibility and accountability. Our Compensation Committee reviews the base salaries and target bonus awards of our named executive officers each year (or otherwise at the time of a new hire or promotion) and recommends any adjustments it deems necessary for Board approval. The base salaries for Mr. Daigle and Mr. Jenke remained the same from fiscal 2024 to fiscal 2025. In fiscal 2025, incentive bonuses were not earned under the 2025 incentive bonus program.

On August 8, 2023, the Board approved the appointment of Robert C. Daigle to succeed Michael Whang as President and Chief Executive Officer of the Company. Mr. Daigle and the Company entered into an Employment Agreement, which is described further below. Pursuant to his employment agreement, Mr. Daigle serves as President and Chief Executive Officer of the Company for a period of three (3) years (the “Term”). Pursuant to his employment agreement, Mr. Daigle (i) will receive an annual base salary of $450,000, (ii) is eligible to participate in the Company’s annual executive bonus program, (iii) was granted an option to purchase 150,000 shares of common stock of the Company (the “Option Grant”) issued under the Company’s 2022 Equity Incentive Plan (the “Equity Incentive Plan”), and (iv) on the Effective Date (as defined in the Employment Agreement) and on each one-year anniversary thereafter, will be granted restricted stock units with an aggregate fair market value equal to $500,000 as of the grant date (the “RSU Grant”). The Option Grant vests ratably on each of the annual anniversaries over the Term, subject to Mr. Daigle’s continued service with the Company; provided, however, that 50,000 shares of such Option Grant vested immediately upon grant. The RSU Grants will vest in full on the one-year anniversary of the grant date, subject to Mr. Daigle’s continued service with the Company. Mr. Daigle also receives medical and other benefits consistent with the Company’s standard policies and is eligible to participate in other Company plans. Depending on the circumstances of termination, Mr. Daigle may be entitled to receive post-termination compensation from the Company.

On February 29, 2024, the Board approved an amendment (“Amendment No. 1”) to Mr. Daigle’s employment agreement, replacing Mr. Daigle’s right to receive future RSU grants with a 5-year, out-of-the money option to purchase 400,000 shares of common stock and the elimination of Mr. Daigle’s right to participate in the Company’s bonus plan. The option vests as follows: (i) 133,333 shares vested and became exercisable on August 8, 2024, (ii) 133,333 shares vested and became exercisable on February 8, 2025, and (iii) the remaining 133,334 shares vested and became exercisable on August 8, 2025, subject to Executive’s continued Service with the Company, as described in the applicable award agreement.

On August 6, 2024, the Board approved a further amendment (“Amendment No. 2”) to Mr. Daigle’s employment agreement, providing that Mr. Daigle shall have the right to exercise all vested options following his termination of employment for the term of each such option grants, provided such termination is not for “Cause” (as defined in his employment agreement). In the event of Mr. Daigle’s death any currently vested options may be exercised for a period of one year after the date of such termination or the remaining term of the option grant, which ever is shorter.

On July 18, 2025, the Board approved a special option grant to Mr. Daigle to purchase 100,000 shares of common stock of the Company pursuant to the Equity Incentive Plan. This special option grant has a term of five (5) years and will vest in full on the one-year anniversary of the grant date.

Mr. Jenke entered into an offer letter with the Company, effective August 8, 2024, in connection with his appointment as Chief Financial Officer of the Company. Under the terms of the offer letter, Mr. Jenke (i) will receive an annual base salary of $280,000, (ii) is eligible to receive a target annual performance-based incentive bonus of $140,000 upon the achievement of established individual and company operational goals paid in 60% cash and 40% restricted stock, and (iii) was granted an option to purchase 30,000 shares of common stock of the Company. Such option vests in three equal increments on the 1-year, 2-year and 3-year anniversary dates of the grants and has a 10-year term.

On November 26, 2025, Mr. Jenke resigned as the Chief Financial Officer and an employee of the Company, effective December 29, 2025. In consideration for agreeing to provide certain post-resignation consulting services, the Company agreed to pay Mr. Jenke an hourly rate equivalent to his current hourly rate for such consulting services and to accelerate the vesting of the first one-third of his 25,000 RSU award granted on March 19, 2025, which one-third is scheduled to vest on March 19, 2026.

Our named executive officers and other eligible employees are entitled to participate in our defined contribution retirement plan that provides eligible U.S. employees with an opportunity to save for retirement on a tax advantaged basis. Eligible employees may defer eligible compensation on a pre-tax or after-tax (Roth) basis, up to the statutorily prescribed annual limits on contributions under the Internal Revenue Code of 1986 (the “Code”). Contributions are allocated to each participant’s individual account and are then invested in selected investment alternatives according to the participants’ directions. We match employee contributions to the 401(k) Plan equal to 60% of the participants' elective deferrals, up to 3.6% of the participants’ eligible compensation each payroll period. Employees are auto-enrolled upon eligibility at a 6% contribution rate; however, an employee may opt out at their election. The 401(k) plan is intended to be qualified under Section 401(a) of the Code with the 401(k) plan’s related trust intended to be tax exempt under Section 501(a) of the Code. As a tax-qualified retirement plan, contributions to the 401(k) plan (except for Roth contributions) and earnings on those contributions are not taxable to the employees until distributed from the 401(k) plan.

We offer welfare benefits that are generally comparable to those offered by other small public companies. We otherwise do not offer any perquisites to our employees. Other than our 401(k) plan, we do not maintain any retirement plan for our named executive officers. We may adopt these plans and confer other fringe benefits for our executive officers in the future.

2025 Long-Term Equity Incentive Awards

Our Compensation Committee is responsible for determining and approving equity incentive awards. As of September 30, 2025, we have generally granted equity awards to our named executive officers in the form of stock options and restricted stock units. Vesting of the stock options and restricted stock units is tied to continuous service with us and serves as an additional retention measure. We do not have a standardized policy for granting annual equity awards to our named executive officers. Our executives generally are awarded an initial grant upon commencement of employment or upon significant promotion. Additional grants may occur periodically in order to incentivize, reward and retain executives as the Compensation Committee determines appropriate, taking into consideration the executive’s aggregate equity holdings. We are thoughtful in the use of our equity pool and resulting dilution to our shareholders; our named executive officers are not guaranteed an equity award grant each year. We currently grant equity awards pursuant to our 2022 Equity Incentive Plan.

On February 29, 2024, as discussed above, the Compensation Committee granted Mr. Daigle an out-of-the-money option to purchase 400,000 shares of common stock of the Company at $6.00 per share. The award vests in equal installments on the first through third six-month anniversaries of the February 29, 2024 grant date. The award expires after a term of five years. On August 6, 2024, the Compensation Committee approved an amendment to Mr.

Daigle’s stock option award agreement to permit Mr. Daigle to exercise vested options following his termination of service for the remaining term of such option grants, subject to certain exceptions set forth in such amendment.

As stated above, upon Mr. Jenke’s appointment as Chief Financial Officer, he received an option to purchase 30,000 shares of common stock. Such options will vest in three equal increments on the 1-year, 2-year and 3-year anniversary dates of the grants and have a 10-year life. Mr. Jenke resigned as Chief Financial Officer effective December 29, 2025. Except as noted above with respect to the acceleration of one-third of his March 2025 RSU grant, upon his resignation, unvested awards granted under the Company’s various equity plans were forfeited.

Timing of Equity Incentive Award Grants

Equity grants made to the named executive officers must be approved by the Compensation Committee. During fiscal 2025, equity awards to employees generally were granted on March 19, 2025, which is around the time of the Company’s annual shareholder meeting. As part of the Company’s annual performance and compensation review process, the Compensation Committee approves stock option awards to our named executive officers in the second fiscal quarter of the following fiscal year, long after the Company’s fiscal year end. The Compensation Committee does not grant equity awards in anticipation of the release of material nonpublic information and the Company does not time the release of material nonpublic information based on equity award grant dates.

In accordance with Item 402(x) of Regulation S-K, we are providing information regarding our procedures related to the grant of stock options close in time to the release of material non-public information. Although we do not have a formal policy that requires us to award equity or equity-based compensation on specific dates, our Compensation Committee and Board have adopted a policy with respect to the grant of stock options and other equity incentive awards that generally prohibits the grant of stock options or other equity awards to executive officers during closed quarterly trading windows (as determined in accordance with our insider trading policy). Our insider trading policy also prohibits directors, officers and employees from trading in our common stock while in possession of or on the basis of material non-public information about us. Neither our Board nor our Compensation Committee takes material non-public information into account when determining the timing of equity awards, nor do we time the disclosure of material non-public information for the purpose of impacting the value of executive compensation. We generally issue equity awards to our executive officers on a limited and infrequent basis, and not in accordance with any fixed schedule. During fiscal 2025, there were no equity awards to any named executive officers within four business days preceding or one business day after the filing of any report of Forms 10-K, 10-Q, or 8-K that discloses material nonpublic information.

2025 Compensation Programs

There were no additional changes implemented for the 2025 compensation programs.

SUMMARY COMPENSATION TABLE

The following table sets forth all of the compensation awarded to, earned by or paid to our named executive officers during our fiscal years ended September 30, 2025 and 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Principal Position |

|

Year |

|

Salary ($) |

|

|

Bonus

($)

(1) |

|

|

Option

Awards

($)

(2) |

|

|

Stock

Awards

($)

(2) |

|

|

All Other

Compen-

sation ($) |

|

|

|

Total ($) |

|

Robert C. Daigle |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chief Executive Officer, |

|

2025 |

|

|

450,000 |

|

|

|

— |

|

|

|

259,410 |

|

|

|

— |

|

|

|

14,170 |

|

(3) |

|

|

723,580 |

|

President and Chairman of the Board |

|

2024 |

|

|

450,000 |

|

|

|

— |

|

|

|

945,960 |

|

|

|

— |

|

|

|

15,339 |

|

(4) |

|

|

1,411,299 |

|

Wade M. Jenke* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vice President, Chief Financial Officer |

|

2025 |

|

|

292,600 |

|

|

|

— |

|

|

|

— |

|

|

|

124,750 |

|

|

|

11,179 |

|

(5) |

|

|

428,529 |

|

|

|

2024 |

|

|

32,308 |

|

|

|

— |

|

|

|

87,897 |

|

|

|

— |

|

|

|

750 |

|

(6) |

|

|

120,955 |

|

____________________

* Mr. Wade M. Jenke was appointed Chief Financial Officer effective August 8, 2024 and resigned effective December 29, 2025. His information is included in the proxy statement in accordance with applicable rules and regulations of the SEC.

(1)No cash bonuses were awarded in fiscal 2025.

(2)Amounts represent the aggregate grant date fair value calculated in accordance with FASB ASC Topic 718. For a description of the assumptions made when calculating such grant date fair value, refer to Note 12 of the consolidated financial statements included in our Annual Report on Form 10-K for fiscal 2025.

(3)Amount represents a Company match of $12,420 under the 401(k) plan and a discretionary contribution to Mr. Daigle’s health savings account.

(4)Amount represents a Company match of $11,839 under the 401(k) plan and a discretionary contribution to Mr. Daigle’s health savings account and to his lifestyle spending account.

(5)Amount represents a Company match of $9,179 under the 401(k) plan and a discretionary contribution to Mr. Jenke’s health reimbursement account.

(6)Amount represents a discretionary contribution to Mr. Jenke’s health reimbursement account and to his lifestyle spending account.

In addition to the above compensation, our named executive officers are reimbursed for reasonable out-of-pocket business expenses and receive customary benefits generally available to all of our employees, including reimbursement of mobile phone expenses, the cost of continuing professional education courses and related benefits.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

The following table sets forth information regarding grants of plan-based option awards held by our named executive officers as of September 30, 2025:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Option Awards |

Name |

|

Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable |

|

|

Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable |

|

|

|

Options

Exercise

Price ($) |

|

|

Option

Expiration

Date |

Robert C. Daigle |

|

|

6,000 |

|

|

|

— |

|

|

|

$ |

9.99 |

|

|

8/12/2031 |

|

|

|

6,000 |

|

|

|

— |

|

|

|

$ |

10.22 |

|

|

3/2/2032 |

|

|

|

150,000 |

|

|

|

— |

|

|

|

$ |

9.00 |

|

|

8/14/2033 |

|

|

|

400,000 |

|

|

|

— |

|

|

|

$ |

6.00 |

|

|

3/1/2029 |

|

|

|

— |

|

|

|

100,000 |

|

(1) |

|

$ |

5.09 |

|

|

8/8/2030 |

Wade M. Jenke |

|

|

10,000 |

|

|

|

20,000 |

|

(2) |

|

$ |

5.37 |

|

|

8/8/2034 |

(1)Unvested option awards will vest in full on August 8, 2026.

(2)Unvested option awards were scheduled to vest in equal installments on the second and third anniversaries of the August 8, 2024 grant date. Mr. Wade M. Jenke resigned as Chief Financial Officer effective December 29, 2005. Upon his resignation, unvested awards granted under the Company’s various equity plans were forfeited; vested awards remained outstanding for 90 days from the date of resignation.

PAY VERSUS PERFORMANCE

Pay Versus Performance Table

As required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and Item 402(v) of Regulation S-K, we are providing the following information about the relationship between executive compensation and certain financial performance of our company for each of the last three completed fiscal years. The table below presents information on the compensation of our CEO and our other named executive officers (“NEOs”) in comparison to certain performance metrics for 2025, 2024 and 2023. We are permitted to report as a

“smaller reporting company” as defined under the U.S. federal securities laws. Accordingly, we have not included a tabular list of financial performance measures, and the table below does not include a column for a “Company-Selected Measure” as defined in Item 402(v) of Regulation S-K.

The table below summarizes the total compensation, compensation actually paid, and other metrics used to evaluate the Named Executives’ compensation to the Company’s performance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

|

Summary Compensation Table Total for CEO ($)(a) |

|

|

Summary Compensation Table Total for Former CEO ($)(a) |

|

|

Compensation Actually Paid to CEO ($)(b) |

|

|

Compensation Actually Paid to Former CEO ($)(b) |

|

|

Average Summary Compensation Table Total for Non-CEO NEO ($)(c) |

|

|

Average Compensation Actually Paid to Non-CEO NEO ($)(d) |

|

|

Net Income (Loss) ($)(e) |

|

|

Value of Initial Fixed $100 Investment Based on Total Shareholder return ($)(f) |

|

2025 |

|

|

723,580 |

|

|

|

- |

|

|

|

841,055 |

|

|

|

- |

|

|

|

428,529 |

|

|

|

514,519 |

|

|

|

(30,326 |

) |

|

|

108.94 |

|

2024 |

|

|

1,411,299 |

|

|

|

- |

|

|

|

1,471,642 |

|

|

|

- |

|

|

|

305,223 |

|

|

|

437,168 |

|

|

|

(8,486 |

) |

|

|

68.24 |

|

2023 |

|

|

1,263,454 |

|

|

|

485,436 |

|

|

|

1,137,734 |

|

|

|

445,549 |

|

|

|

318,107 |

|

|

|

260,130 |

|

|

|

(12,582 |

) |

|

|

89.65 |

|

a)The amounts in these two columns represents the total compensation of our chief executive officer, Mr. Daigle, for the fiscal years ended September 30, 2025, 2024 and 2023 and for our former CEO, Mr. Whang, for each of the fiscal years ended September 30, 2023, as reported in the Summary Compensation Table included in the Executive Compensation section of this proxy statement. As noted elsewhere in this proxy statement, Mr. Daigle was appointed principal executive officer of the Company effective August 8, 2023. Mr. Whang served as our principal executive officer until August 8, 2023.

b)The amounts in this column represent the total compensation actually paid to the CEO for the years indicated, adjusting the total compensation from column (a) by the amounts in the “Adjustments” table below.

c)The amounts in this column represents the average total compensation of our Named Executive Officers, excluding the CEO (the “Non-CEO NEOs”), Lisa Gibbs for each of the fiscal years ended September, 30, 2024 and 2023 and Mr. Jenke for the fiscal year ended September 30, 2025 and 2024, respectively, as reported in the Summary Compensation Table of the proxy statement filed in the applicable year. Ms. Gibbs resigned as Chief Financial Officer, effective August 7, 2024. Mr. Jenke was appointed Chief Financial Officer of the Company effective August 8, 2024 and resigned effective December 29, 2025.

d)The amounts in this column represent the average total compensation actually paid to the Non-CEO NEO for the years indicated, adjusting the total compensation from column (d) by the amounts in the “Adjustments” table below.

e)The amounts in this column (in thousands) represent the Company’s net income (loss) for the indicated years as reported in the Company’s Annual Report on Form 10-K filed with the SEC.

f)The amounts in this column represent the cumulative total shareholder return of a fixed investment of $100 made at the closing price of the Company’s common stock at September 30, 2022 for the measurement period beginning on such date and continuing through and including the end of the applicable fiscal year reflected in the table. Because the covered years are presented in the table in reverse chronological order (from top to bottom), the table should be read from bottom to top for purposes of understanding cumulative returns over time.

The table below represents the amount of compensation actually paid to the PEO and to the Non-PEO NEOs as computed in accordance with Item 402(v) of Regulation S-K. The amounts do not reflect the actual compensation earned or paid during the applicable fiscal year.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PEO |

|

PEO |

|

Non-PEO NEOs |

|

Average Non-PEO NEOs |

|

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

Total from Summary Compensation Table (SCT) |

|

|

723,580 |

|

|

1,411,299 |

|

|

428,529 |

|

|

305,223 |

|

Less the amounts reported under the Stock Awards column in the SCT |

|

|

- |

|

|

- |

|

|

(124,750 |

) |

|

- |

|

Less the amounts reported under the Option Awards column in the SCT |

|

|

(259,410 |

) |

|

(945,960 |

) |

|

- |

|

|

82,823 |

|

Plus Year-End Fair Value of Outstanding and Unvested Equity Awards Granted in the Year |

|

|

634,700 |

|

|

828,798 |

|

|

125,360 |

|

|

48,990 |

|

Year over Year Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Years |

|

|

- |

|

|

(57,099 |

) |

|

60,040 |

|

|

- |

|

Plus Fair Value as of Vesting Date of Equity Awards Granted and Vested in the Same Year |

|

|

- |

|

|

370,002 |

|

|

- |

|

|

- |

|

Year over Year Change in Fair Value of Equity Awards Granted in Prior Years which Vested in the Year |

|

|

(257,815 |

) |

|

(135,398 |

) |

|

25,340 |

|

|

132 |

|

Add dividends paid in fiscal year |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Equals compensation actually paid in fiscal year |

|

|

841,055 |

|

|

1,471,642 |

|

|

514,519 |

|

|

437,168 |

|

Adjustments from Total Compensation to Compensation Actually Paid

The amounts reported in the “Compensation Actually Paid to CEO” and “Compensation Actually Paid to Non-CEO NEOs” columns do not reflect the actual compensation paid to or realized by our CEO or our Non-CEO NEOs during each applicable year. The calculation of compensation actually paid for purposes of this table includes point-in-time fair values of stock awards and these values will fluctuate based on our stock price, various accounting valuation assumptions and projected performance related to our performance awards. See the Summary Compensation Table for certain other compensation of our CEO and our Non-CEO NEOs for each applicable fiscal year and the Outstanding Equity Awards at September 30, 2025 table for the value realized by each of them upon the vesting of stock awards during our fiscal year ended September 30, 2025.

The table above summarizes the adjustments made to the total compensation as reported in the Summary Compensation Table included in the Executive Compensation section of this proxy statement to determine the total actual compensation paid to the CEO and Non-CEO NEOs for the years indicated as reported in the table above.

EMPLOYMENT AND CHANGE IN CONTROL ARRANGEMENTS

Employment Agreement with Chief Executive Officer

As of August 14, 2023 (the “Effective Date”), we entered into an Employment Agreement with Robert Daigle, our President and Chief Executive Officer (the “Original Employment Agreement”). That Employment Agreement was amended by Amendment No. 1, dated effective as of February 29, 2024 (“Amendment No. 1”) and Amendment No. 2, dated effective as of August 6, 2024 (“Amendment No. 2” and, together with Amendment No. 2, the “Employment Agreement”). Below is a summary of the terms and conditions of the Employment Agreement.

Term

The employment agreement has an initial term of three years.

Compensation, including Bonus and Equity Awards

Under the terms of Mr. Daigle’s Original Employment Agreement he (i) is entitled to receive an annual base salary of $450,000, (ii) was eligible to participate in the Company’s annual executive bonus program adopted by our Compensation Committee, (iii) was granted an option to purchase 150,000 shares of common stock of the Company (the “Option Grant”) issued under the 2022 Equity Plan (the “Equity Plan”), and (iv) on the Effective Date and on each one-year anniversary thereafter, be granted restricted stock units with an aggregate fair market value equal to $500,000 as of the grant date (the “RSU Grant”). The Board or a committee of the Board is required to review Executive’s performance on at least an annual basis and may increase, but not decrease, such base salary if, in its sole discretion, any such adjustment is warranted, provided, however, the base salary may be decreased in connection with salary reductions implemented by the Board or a Committee of the Board applicable to all executives of the Company. During his employment with the Company, Mr. Daigle will no longer be compensated for his service as the Company’s Chairman of the Board; provided, however, that any unvested equity awards previously issued to Mr. Daigle during his service as a Board member shall continue to vest based on Mr. Daigle’s continued service as an employee or a member of the Board.