Entrepix acquisition overview JANUARY 2023 Exhibit 99.2

Safe Harbor Statement This Presentation may contain certain statements or information that constitute “forward-looking statements” (as such term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995). In some, but not all, cases, forward-looking statements can be identified by terminology such as “may,” “plan,” “anticipate,” “seek,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “continue,” “predict,” “potential,” “project,” “should,” “would,” “could”, “likely,” “future,” “target,” “forecast,” “goal,” “observe,” and “strategy” or the negative of these terms or other comparable terminology. Examples of forward-looking statements include statements regarding Amtech System, Inc.’s (“Amtech” or the “Company”) future financial results, operating results, business strategies, projected costs, products under development, competitive positions, plans and objectives of Amtech and its management for future operations, efforts to improve operational efficiencies and effectiveness and profitably grow our revenue, and enhancements to our technologies and expansion of our product portfolio. Such forward-looking statements and information are provided by the Company based on current expectations of the Company and reflect various assumptions of management concerning the future performance of the Company, and are subject to significant business, economic and competitive risks, uncertainties and contingencies, many of which are beyond the control of the Company. Accordingly, there can be no guarantee that such forward-looking statements or information will be realized. Actual results may differ materially from historical results and expectations based on forward-looking statements made in this document or elsewhere by Amtech or on its behalf. No representations or warranties are made as to the accuracy or reasonableness of any expectations or assumptions or the forward-looking statements or information based thereon. Only those representations and warranties that are made in a definitive written agreement related to a transaction, when and if executed, and subject to any limitations and restrictions as may be specified in such definitive agreement, shall have any effect, legal or otherwise. Each recipient of forward-looking statements should make an independent assessment of the merits of and should consult its own professional advisors. Except as required by law, we undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events, or otherwise.

“Amtech Systems Acquires Entrepix, a Globally Recognized Expert in CMP and Wafer Cleaning” JANUARY 17, 2023

200mm CMP and Wafer Clean Leader ENTREPIX ACQUISITION Solid Performance Track record of solid EBITDA performance. Less cyclical revenue streams. Compound Semi Customer Base Strong participation in Compound Semi applications. Multiple product offerings. Entrenched in CMP Process experts in CMP. Trusted process partner for leading fabs. Supporting EV growth across the entire portfolio ~20% of revenue is derived from Compound Semi customer applications, estimated WAFER CLEANING EQUIPMENT CMP EQUIPMENT UPGRADES CMP PARTS &SERVICE Supporting EV growth across the entire portfolio

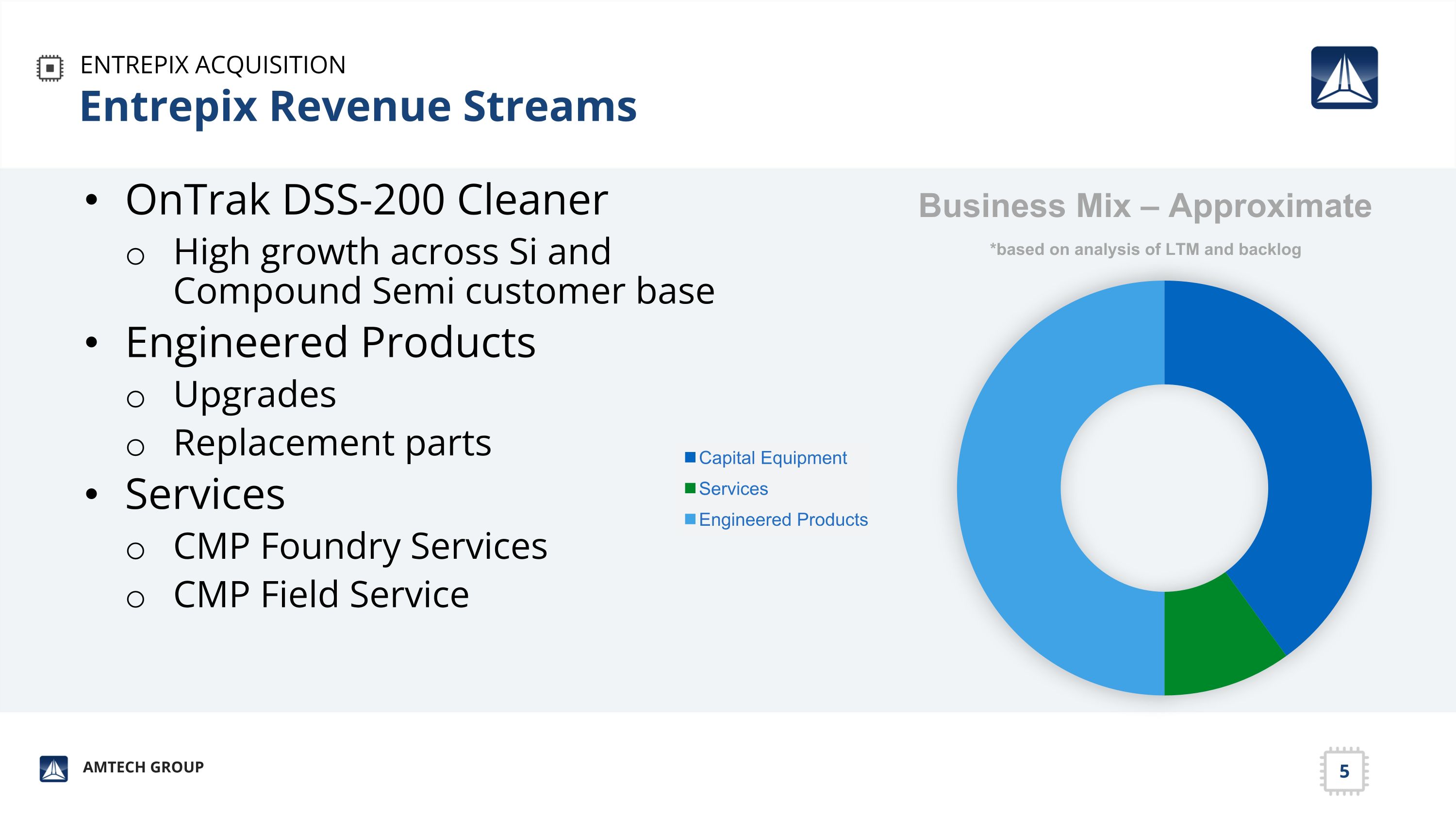

Entrepix Revenue Streams ENTREPIX ACQUISITION OnTrak DSS-200 Cleaner High growth across Si and Compound Semi customer base Engineered Products Upgrades Replacement parts Services CMP Foundry Services CMP Field Service

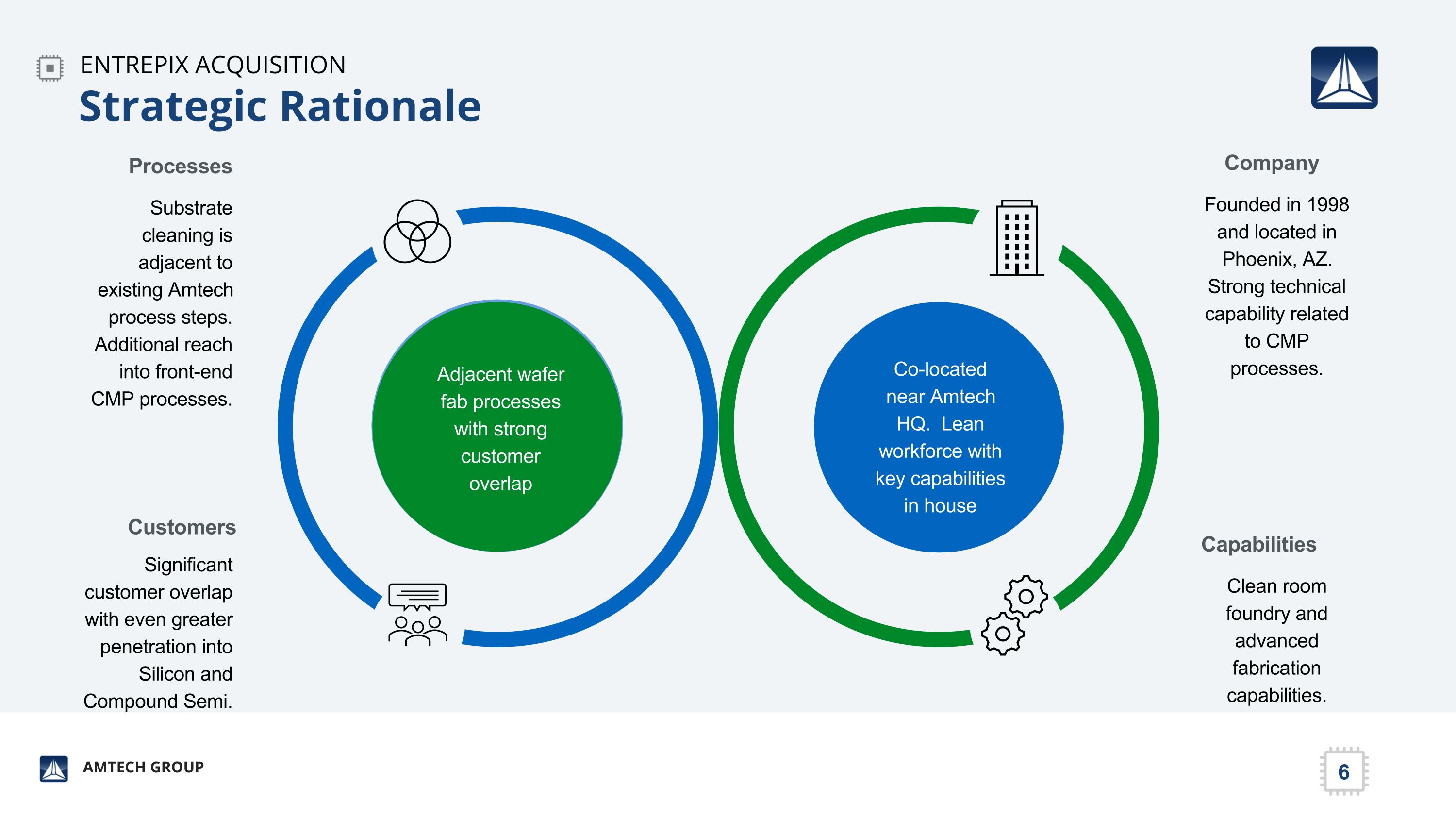

Substrate cleaning is adjacent to existing Amtech process steps. Additional reach into front-end CMP processes. Processes Significant customer overlap with even greater penetration into Silicon and Compound Semi. Customers Founded in 1998 and located in Phoenix, AZ. Strong technical capability related to CMP processes. Company Clean room foundry and advanced fabrication capabilities. Capabilities Adjacent wafer fab processes with strong customer overlap Co-located near Amtech HQ. Lean workforce with key capabilities in house Strategic Rationale ENTREPIX ACQUISITION 6

ENTREPIX ACQUISITION Amtech Divisions in the Semiconductor Ecosystem

Value Creation – Development of Amtech CMP Ecosystem Entrepix’s CMP leadership can enable adoption for existing Amtech companies including PR Hoffman polishing equipment and Intersurface Dynamics consumable CMP process chemicals Process development Demonstration center Line bundling Allows for integrated approach for CMP process: Polish/Wet Process Chemical/Clean ENTREPIX ACQUISITION

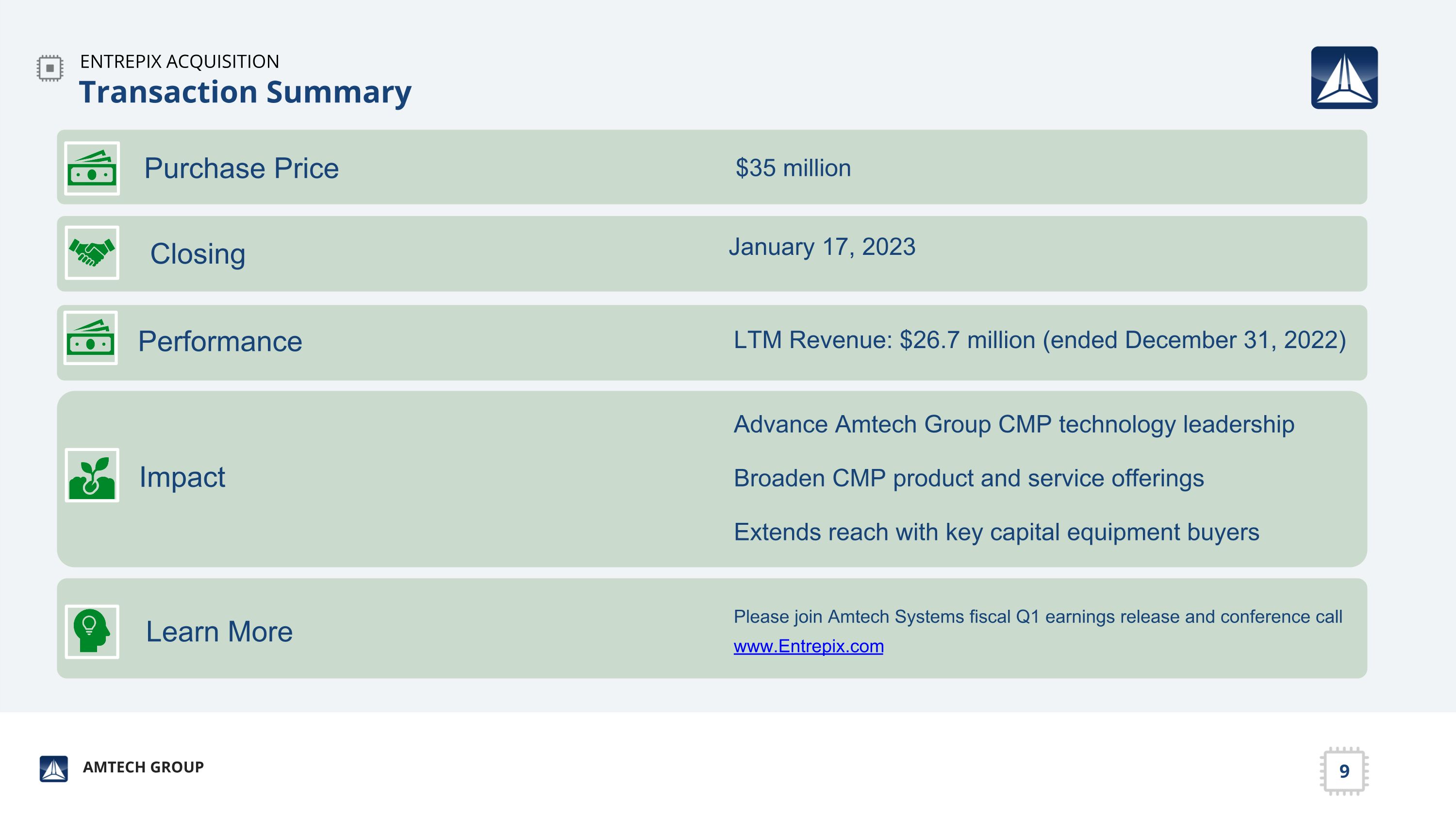

Transaction Summary Purchase Price $35 million Closing January 17, 2023 Performance LTM Revenue: $26.7 million (ended December 31, 2022) Impact Advance Amtech Group CMP technology leadership Broaden CMP product and service offerings Extends reach with key capital equipment buyers Learn More Please join Amtech Systems fiscal Q1 earnings release and conference call www.Entrepix.com ENTREPIX ACQUISITION